News back to homepage

|

SPECIAL COMMENT: Islamic finance, halal industry & Shariah-compliant hotels during Ramadhan(0) Ramadhan is a period of introspection for Muslims and Islamic financial institutions to better observe Islamic teachings, appreciate our blessings and be moved to action by the burdens of others. In short, it’s a month of narrowing the gap between the rich and the poor. For Islamic finance – it is a merger of faith and finance, Halal industry - merger of faith and food, and Shariah compliant hotels - merger of faith and hospitality. Ramadhan offers the most brand building opportunities through PR exercises such as sponsoring Ramadhan tents/foods and Azans, launching of new products and donations to mosques and orphans as well as hand outs of Corporate Gifts to Muslims clients, for most conscious-minded institutions. But, four questions come to mind; 1. Is Ramadhan the most opportune time to recruit more ‘bankable’ customers? 2. Do the photo-ops and press releases cancel out the spirit of donations and good intentions? 3. Should the right hand know what, when, where and how much the left hand is giving? 4. Is Ramadhan becoming a PR bandwagon everyone is jumping into? |

|

SPECIAL COMMENT: A Different Kind of Consolidation in Islamic Finance(0) One of the most over-used words in Islamic finance is not standardization, scholars, regulations, etc., but ‘consolidation’. Islamic banks, Islamic leasing companies, Takaful companies need to consolidate to reach size and achieve scale. As larger capitalized entities, they can better compete with not just the Islamic windows and subsidiaries of conventional banks and insurance companies (like HSBC or Prudential) but eventually the larger conventional financial institutions for mandates on project finance, M&A, buyouts, and so on. Then again, what about consolidation amongst the Islamic industry bodies, the likes of AAOIFI (Accounting and Auditing Organization of Islamic Financial Institutions), IIRA (International Islamic Rating Agency), IIFM (International Islamic Financial Market), and CIBAFI (General Council for Islamic Banks & Financial Institutions)? |

|

After Losing $33B in H1, Gulf Markets Hope For Better Second Half(1) Gulf markets have lagged other global emerging and developed markets for years. Even as the S&P 500 and other emerging market indices rescaled their pre-Lehman levels, Gulf markets have stayed listless, drifting lower and lower until they have plumbed new depths. But have the markets finally bottomed out? With the Gulf economies seeing major improvement in their fortunes, thanks to government stimulus, will it rub off on the markets as well in the second half of the year? Gulf markets lost USD33.4-billion in market capitalization in the first half of the year due to a number of factors that conspired to negatively impact investor sentiment. |

|

SPECIAL COMMENT: Does Islamic Finance have A.I.R. (Authenticity, Innovation & Reach)?(0) At the Joint High Level Conference on Islamic Finance in Jakarta, Indonesia, co- organized by Bank Negara Malaysia and Bank Indonesia, the question I wanted to address was: Does Islamic Finance have A.I.R. (Authenticity, Innovation & Reach) or is it just hot air? |

|

Why Are Western Policymakers Playing This Dangerous Game of Jenga?(0) Global investors and market participants are frustrated by US, EU and Japanese policymakers, arguing that politicians are ‘kicking the can down the road’ instead of solving the problems of their debt-laden economies. READ MORE HERE |

|

Global Petroleum Survey: Oil Companies See Iraq Fraught With Regulatory Hurdles; Qatar Tops Survey(0) The Fraser Institute’s Global Petroleum Survey is the latest where super-rich Qatar beats its regional competitors’ as it pips them to the post as the Middle East’s most investment-friendly destination for petroleum exploration and development. READ MORE HERE

|

|

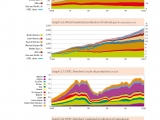

Opec 2011 Bulletin’s 18 Most Important Pages (In Charts)(0) Opec’s annual bulletin reveals the changing dynamics of the energy industry and the key challenges facing both the producers and the consumers. Click through the charts to find out more: |

|

Saudi breakeven oil price to hit $321, if spending pattern continues: analyst(0) Forget Arab Spring. If Saudi Arabia’s spending patterns and economic policies don’t change, it could be staring at a breakeven oil price of an astonishing $320 a barrel by 2030, says Jadwa. With $562-billion in net foreign asset, the second largest oil reserves in the world after Venezuela (according to the latest Opec bulletin), and the second largest oil output in the world after Russia - Saudi Arabia’s future looks rosy and solid. READ MORE HERE |

Tags

Categories

Recent Posts

- China and India dominate gold buying in second quarter

- Why Oil Prices Will Continue To Remain High

- ‘A fifth of Saudi Companies Likely to Fall Under the ‘Red’ Zone’ says Saudi Minister of Labour

- Videos We Like: Battle For Tripoli (Al Jazeera)

- An Arab Spring In The United States?

- SPECIAL COMMENT - The need of the hour: an Islamic Sovereign Wealth Fund

- Morgan Stanley’s Global Recession Warning

- Making Of A Real Estate Boom In Saudi Arabia

- EU Sanctions Needed To Weaken Cruel Syrian Regime

- SPECIAL COMMENT: Ramadan-inspired Dates Index & kebabonomics