Gold back to homepage

|

Gold Will Plateau At $2,000: Analysts(0) After a hiatus that lasted several months, gold bugs are waking up from their hibernation. And now they are calling for the elusive USD2,000 for the precious metal within a year. But that’s about as far as it is going to get. READ MORE HERE |

|

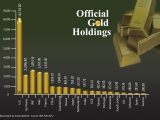

World’s Official Biggest Gold Holdings(0)

Central banks’ have been major buyers of gold over the past few years, especially after the U.S. dollar and euro wobbled. Here is a list of the countries with the biggest official gold reserves. READ MORE HERE |

|

Buffett May Hate It, But Asians Love Gold(0) Given the latest gold trends, emerging market investors and central banks appear to humbly disagree with Warren Buffett’s assertion that the yellow metal has limited uses. READ MORE HERE |

|

Why Warren Buffett Hates Gold(0) Warren Buffett, the Oracle of Omaha, sets out his theory on gold and explains why he is not enamoured by its charms. And why there is no treasure to be found in Treasuries. READ MORE HERE |

|

Is Gold Rally Over?(0) Gold haters are predicting the end of the gold rally. But pro-gold analysts say central bank bullying, inflation and negative interest rates will continue to propel the yellow metal forward. READ MORE HERE |

|

Gold SWOT: CME May Raise Margin Requirements Once More(0)

For the week, spot gold closed at $1,788.68, up $34.03 per ounce, or 1.94 percent. Gold stocks, as measured by the NYSE Arca Golds BUGS Index, rose 1.57 percent. The U.S. Trade-Weighted Dollar Index was essentially flat, with a slide of just 0.02 percent for the week, says Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investor |

|

Gold SWOT Report: Potential For A Significant Rebound(0)

U.S. Global Investors examine the strength, weaknesses, opportunities and threats for the yellow metal: |

|

Why Gold’s Vulnerable(0) Gold walked up the stairs and came down the elevator. And as chatter of a global recession rises, the ‘safe haven’ may not be the place to be parking your funds, says BarCap. How the mighty have fallen. From calls of $2,000 to $2,500 before the end of the year, gold pundits are scrambling to scale back their forecast for the yellow metal as talks of recession become more widespread. READ MORE HERE |

|

Why Gold’s Vulnerable In A Recession: Barclays Capital(0) Gold walked up the stairs and came down the elevator. And as chatter of a global recession rises, the ‘safe haven’ may not be the place to be parking your funds, says BarCap. How the mighty have fallen. From calls of $2,000 to $2,500 before the end of the year, gold pundits are scrambling to scale back their forecast for the yellow metal as talks of recession become more widespread. READ MORE HERE |

|

Gold’s ‘honest’ price $10,000, says Societe Generale(0) We should dismiss exclamations by gold bugs who think gold prices should be way higher, say $3,000 or $5,000. But when SocGen’s global strategy team thinks gold’s ‘honest price’ is $10,000, one should sit up and take notice. Dylan Grice, part of SocGen’s global strategy team analyst, says that with global demand for non-debased currency surging, last week’s capitulation by the Swiss demonstrated once again the perverse risk inherent in doing the right thing. It also narrowed the already shrunken universe of sound |

Tags

Categories

- Africa

- Alifarabia.com

- Angola

- Bahrain

- Central Asia

- Egypt

- Egypt & MENA

- Featured Gold

- Featured Islamic Finance

- Featured Qatar

- Featured Saudi Arabia

- Featured UAE

- Feaured Egypt

- Ghana

- Gold

- Gulf

- Hot Topics

- Iraq

- Islamic Finance

- Kenya

- Kuwait

- Libya

- Macroeconomic Data

- Markets

- Nigeria

- North Africa

- Oil

- Oman

- Qatar

- Rwanda

- Saudi Arabia

- Slider

- South Africa

- Tanzania

- The Levant

- UAE

- Uncategorized

- Videos We Like

Popular Posts

The weakest link: short-term liquidity and how it impacts Islamic finance

The weakest link: short-term liquidity and how it impacts Islamic finance  Islamic finance: An industry inclusive to all, irrespective of background

Islamic finance: An industry inclusive to all, irrespective of background  SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital

SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital  Media and public relations — the missing link in Islamic finance

Media and public relations — the missing link in Islamic finance  SPECIAL COMMENT: OIC Islamic Index - The Malaysia Story?

SPECIAL COMMENT: OIC Islamic Index - The Malaysia Story?  SPECIAL COMMENT: Ramadan Wish List For Islamic Finance

SPECIAL COMMENT: Ramadan Wish List For Islamic Finance  Natural gas to be fastest growing energy source

Natural gas to be fastest growing energy source  Dull economy takes shine away from Cameroon

Dull economy takes shine away from Cameroon  Mozambique political tensions seen rising in 2014

Mozambique political tensions seen rising in 2014  Muslim consumerism is linked to real economy sectors

Muslim consumerism is linked to real economy sectors

Popular Posts

Sorry. No data so far.