Qatar back to homepage

|

How The S&P Downgrade Impacts the Gulf States(0)

The Standard & Poor’s downgrade of the U.S. economy was the great unthinkable just a few months ago. They are now a stark reality. While the short-term impact may not be immediate - save for market gyrations, it is long-term implications are clear: the U.S. economy is no longer the safest, the most dynamic and the most enduring in the world, and U.S. Treasuries - may be not tomorrow but certainly over time - will no longer the safe havens everybody counted on. The Gulf states which have aligned itself to the U.S. Dollar in more ways than one, also need to think radically outside their dollar-filled box. While, don’t expect Gulf states to publicly speak negatively about the U.S. economy or the dollar, one certainly hopes that behind closed doors, there is a concerted hope to realign the regional economies to the new realities. READ MORE HERE |

|

After Losing $33B in H1, Gulf Markets Hope For Better Second Half(1) Gulf markets have lagged other global emerging and developed markets for years. Even as the S&P 500 and other emerging market indices rescaled their pre-Lehman levels, Gulf markets have stayed listless, drifting lower and lower until they have plumbed new depths. But have the markets finally bottomed out? With the Gulf economies seeing major improvement in their fortunes, thanks to government stimulus, will it rub off on the markets as well in the second half of the year? Gulf markets lost USD33.4-billion in market capitalization in the first half of the year due to a number of factors that conspired to negatively impact investor sentiment. Scridb filter |

|

Global Petroleum Survey: Oil Companies See Iraq Fraught With Regulatory Hurdles; Qatar Tops Survey(0) The Fraser Institute’s Global Petroleum Survey is the latest where super-rich Qatar beats its regional competitors’ as it pips them to the post as the Middle East’s most investment-friendly destination for petroleum exploration and development. READ MORE HERE Scridb filter |

|

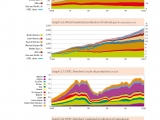

Opec 2011 Bulletin’s 18 Most Important Pages (In Charts)(0) Opec’s annual bulletin reveals the changing dynamics of the energy industry and the key challenges facing both the producers and the consumers. Click through the charts to find out more: Scridb filter |

|

No Arab Spring Dividends For The Middle East?(0) The Arab World’s tryst with democracy and freedom is unlikely to bear economic fruits, according to a study. Instead, we could well see a gridlock political environment and economic growth that continues to lag global averages. The Economist Intelligence Unit (EIU) insightful study on how the Arab Spring initiative is likely to play out, suggests a 60% probability of a gridlocked political environment that is unlikely to result in realizing the aspirations of the region’s citizens. READ MORE HERE Scridb filter |

|

Egypt Spurns The IMF And Rushes Into The Arms Of Gulf States(0) Even as the Egyptian Government looks to revive the country’s economy, it has turned down the International Monetary Fund (IMF)’s stand-by agreement. A bold move no doubt, but was it a populist decision or purely a financial one? And if the Egyptian Government’s decision to turn down the IMF a move to spurn Mubarak-praising entities, why is it borrowing from the Gulf? Egypt’s decision to turn down International Monetary Fund (IMF) and the World Bank is a bold move, given that the country’s fiscal situation remains fragile. READ MORE HERE Scridb filter |

|

What’s In Store For The Global Economy In Second Half(0) As investors say goodbye to the first half of the year and brace themselves for a strange and uncertain world in the second half, the worry beads are already out.Global economies have stuttered, faced natural disaster of epic proportions, seen political upheavals that nobody could have forecasted and have seen new and old worries surface and resurface.Yet markets have remained resilient for the most part, commodity-driven economies have prospered and emerging economies are still managing to expand and grow.Here is a look at what is keeping investors awake at night and some bright spots in an increasingly uncertain world. READ MORE HERE Scridb filter |

|

MSCI Keeps The Door Ajar For UAE & Qatar(0) MSCI has kept the door ajar for both Qatar and the UAE, but EFG-Hermes and Citibank analysts disagree whether either market will be elevated come December. Meanwhile, emerging market funds are already swirling around. The MSCI left the door open for UAE and Qatar to allow them entry into the exclusive emerging markets club. The influential index provider that is used by many funds and investors as a benchmark, said that while both countries did not make the cut this time, they will extend their review till December. READ MORE HERE Scridb filter |

|

Cast Your Vote In Arab Spring Awards(0) Spring is nearly six months old. It is time to take stock, remember those who lost their lives and continue to fight, and hand out some well-deserved awards to the key players. The New York Times columnist Nicholas Kristof, asked the rhetorical question ‘What Country Handled Arab Spring The Best? His own answer: Morocco. But he left the discussion at that. Given that the Arab Spring is just about six months old, alifarabia.com was inspired to take stock of how the various countries have handled a revolution that has smashed Middle East dogmas, broken the will of Arab strongmen and given hopes to millions not just in the Arab World but also around the world. The Middle East has seen more public participation in politics in the past six months than it has done over the past 50 years. Much to the shock of Zine El Abidine Ben Ali, Hosni Mubarak and Moamer Qaddhafi, the people of the Arab World launched a unique coup that they could not have fathom and never saw coming. These strongmen were looking to suppress indigenous Islamic movements, the radicals, Al-Qaeda sympathisers, the socialists, the Shiaas and the sufis. They were looking for tangible forces they could fight, and suppress and imprison and maim - as they had done in the past. Scridb filter |

|

High-Spending Gulf In Dilemma As Opec Loses Relevance(0) With Opec seemingly irrelevant, the GCC is trying to find a balance between responsible crude suppliers and their own domestic needs. But, as Deutsche Bank warns, their own high breakeven prices are making them even more vulnerable to oil price shocks than before. READ MORE HERE Scridb filter |

Tags

Categories

Popular Posts

Sorry. No data so far.

Popular Posts

Sorry. No data so far.