Posts tagged as: financing back to homepage

|

Open Letter to IDB President: Mega Islamic Trading Platform(0) By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters Dear Dr. Ahmad Mohamed Ali, President, Islamic Development Bank (IDB) Group: Asalaam Alaikum: The Islamic finance world welcomes your comments on the ‘Mega’ Islamic Bank to effectively compete against well capitalized conventional financial institutions. “…The ‘Mega Islamic Bank’ comes as an initiative of the Islamic Development Bank in its efforts to address the dearth of senior financiers, the absence of the Islamic tools of stock exchange and the absence of market liquidity between Islamic banks.” However, $1 billion, with $500 million in paid capital by the three founders (IDB, Dallah Albaraka and Qatar Government), is smaller than three existing Islamic banks, which have never addressed themselves as ‘mega.’ The three include Saudi Arabia’s Al Rajhi, Qatar’s Mashraf Al Rayan and Kuwait’s Kuwait Finance House (KFH). Furthermore, it seems the ‘mega’ story may be incomplete without Malaysia’s participation. Scridb filter |

|

Libya Revisited(0) The figures are in: Libya’s civil war cost the country a 60% contraction in GDP as forces loyal to maverick leader Moammer Gaddafi tried in vain to contain the rising tide of rebels eager to rid the country of the brutal dictator. With NATO air cover and Arab arms and financing feeding the rebels, it was inevitable that the regime would fall. What was even more inevitable was Colonel’s Gaddafi’s death at the hands of a ragtag army of rebels in the most grisly fashion on the streets of Sirte. READ MORE HERE Scridb filter |

|

SPECIAL COMMENT: Shariah Equity Compliance in the West(1) By Rushdi Siddiqui, Global Head of Islamic Finance at Thomson Reuters The time has arrived to take a deeper dive on better understanding of Shariah compliant companies in an Islamic (or Shariah compliant) equity indexes. To many informed and uninformed observers of Islamic equity investing, it seems to imply investing in publicly listed companies in Muslim countries. The end results contradict the assumptions. This also rebuts the often heard allegations by many from the anti-Shariah movement that Islamic investing is about investing in companies linked to terrorism or financing terrorism. The largest companies in the S&P Global BMI Shariah include ExxonMobil, IBM, Chevron, Nestle, Microsoft, etc. |

|

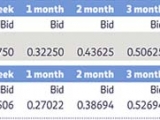

A Step Forward For Islamic Finance Authenticity: IIBR(0) By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters ‘Don’t cheat the world of your contribution. Give it what you’ve got.’ - Steven Pressfield On November 22, 2011, the world’s first Islamic interbank benchmark rate (IIBR) was launched. It is the result of a collaborative approach taken by many Islamic financial institution, industry associations, and Shariah scholars, over the course of 24 months, to a decades-old industry challenge: how to decouple Islamic finance from a conventional Western pricing benchmark (LIBOR) and the law of necessity when an ‘Islamic’ alternative was not available. The objective was to support and preserve Islamic finance authenticity. |

|

‘Cross pollinating’ Islamic finance in GCC, Malaysia(0) Continuous effort - not strength or intelligence - is the key to unlocking our potential. - Winston Churchill How many Malaysian Islamic bankers work in senior positions at Islamic financial institutions in the GCC (Gulf Cooperation Council), Pakistan and the UK? Conversely, how many non-Malaysians work in senior positions at Malaysian Islamic financial institutions? Does the training and experience in Malaysia for Islamic finance somehow imply that it’s too Malaysia-centric (Shafi school) for GCC (Hanbali, Hanafi, Jafri schools) Islamic financial institutions? Does it somehow imply that there needs to be a “retraining” of Malaysian Islamic bankers to the GCC “way” of Islamic banking, finance and takaful? |

|

$25Bn Gulf Debt Maturities In 2012 Pose Risk: S&P(0) Standard & Poor’s Ratings Services said today that issuers in the Gulf Cooperation Council (GCC) countries face rising refinancing risks over the next three years because the amount of debt maturing in the region will increase significantly between 2012-2014. Industry experts estimate bonds and sukuk of about $25 billion will mature in 2012, rising to about $35 billion in 2014. Standard & Poor’s believes the region is therefore entering a challenging loan and bond refinancing cycle, especially given the ongoing volatility in capital markets and fears that slowing global economic growth is already curbing corporate debt issuance and heightening refinancing risk in the region. |

|

Islamic Finance: Too Early For Public Good Test?(0) By Rushdi Siddiqui, Global Head, Islamic Finance & OIC Countries, Thomson Reuters Has Islamic finance passed the ‘public good’ test? HRH Dr Raja Nazrin Shah, the charismatic Crown Prince of Perak and Financial Ambassador of Malaysia Islamic Finance Center (MIFC), made reference to the public good concept during a recent event held by Securities Commission and Oxford Center of Islamic Studies. He said, ‘…If every aspect of Islamic finance were to be subject to a public good test, arguably no negative repercussion could ever arise.’ The Crown Prince is on point, but Islamic finance today is still far away from the ideal or lofty objectives of this niche market. Today’s Islamic finance has not reached the critical mass and penetration even among Muslim countries to be considered for a ‘public good’ test! In about 40 years, it remains about 1% of global banking assets with varying presence in about 30 of 57 Muslim countries, and has reached about 2 to 3% of 1.6 billion Muslims. The conversation in Islamic finance during the decade has been, and continues to be, about lack of standardization, lack of enough scholars and qualified people, and level regulatory playing field. Islamic fund assets under management are about the size of the paid up capital of Islamic banks, $50-70 billion, and Takaful premiums are still in the single billion dollar digits. Sukuk has inadvertently become the alter-ego of Islamic finance, hence, Islamic finance health pulse is the sukuk, but its only 13% of this niche market. The Muslims at the ‘bottom of the pyramid’ are financially disenfranchised as they are not within the traditional deposit-taking community. The bulk of Muslims, living on less than $2/day, are not interested in sukuk, capital protected funds, Islamic hedge funds, AAOIFI standards or IFSB prudential regulations, but want access to Islamic micro-finance/funds, SME financing, venture capital, and so on. They, the non-bankable, want the dignity to financially provide and take care of their families. This is the stress test of ‘public good,’ as Islamic finance is about social justice, equity, and inclusion. Islamic Business Models The Shariah prohibitions against interest, uncertainty and leverage plus the embryonic nature of Islamic finance saved it from ‘replicating’ toxic assets on their balance sheet in stage one of the post crisis-period. Yet, Islamic banks in Bahrain, UAE, and elsewhere continue to report non-performing loans (NPLs) and provisioning as exposure to the vertical chain of real estate institutions at commercial, retail and personal continue to impact performance adversely. The six-month index performance for financial sector shows S&P Global BMI Financial Index up nearly 5%, S&P Bahrain financial up 0.57%, S&P UAE Financial down 12% and S&P GCC Composite financial down 5%. The question is: where are the poster children of Islamic finance today? Gulf Finance House (Bahrain) and Investment Dar (Kuwait) were winning numerous industry awards, including Islamic Banker of the Year, until two years ago. Now they are case studies for dubious business models, and consequences of concentration risks (real estate) and Islamic ‘over-leverage.’ Another question: Will the risk-sharing nature of Islamic finance allow ‘claw back lawsuits’ against certain self-enriched Islamic investment bank CEOs while the bank is presently on life-support restructuring? Where was the governance that is closely linked to the ‘public good?’ The credit crisis was a wake-up call for Islamic finance, as it was following the conventional path of ‘financializing’ the real economy with many conventional instruments ‘Islamisized.’ The end result would have been a public perception similar to the conventional financial sector: loss of trust. For example, according to a recent survey, Business for Social Responsibility Globe Scan of Sustainable Business poll, the financial sector was considered as the least socially responsible sector. PR For Public Good Finally, extending the present partial ‘public good’ associated with Islamic finance, how is Islamic finance perceived in non-Muslim countries interested in this niche market? If it’s partially passing the public good test, assuming public good cuts across geographies and religion, then why the hostility against Islamic/Shariah finance in the world’s largest democracy, India, or world’s largest economy, US? According to recent Wikileaks cable, former US Secretary of State, Condilezza Rice, inquired about the possibility of Islamic finance funding extremists. Another example from a prominent blogger in the space, Blade Goud, discusses the recently published U.S. Department of Defense funded study of ‘… a hypothetical three stage economic war on the U.S. economy where Islamic finance plays a role in facilitating what the report refers to as ‘economic jihad’.’ Finally, in Korea, certain religious quarters, ‘men of the cloth,’ have raised the issue of extremist financing associated with Islamic finance, hence, putting on hold parliamentary discussions/voting on the leveling of the taxes for sukuk issue. Islamic finance in Muslim countries is often a Friday khuutba, where it’s preaching to the converts. The real ‘test’ is actually two-fold: (1) merits of Islamic banking in a Muslim country (answering the question, ‘whats the difference?’) as a business proposition, and (2) convincing the non-Muslim country financial stakeholders of the ethical and social nature of Islamic finance from end to end. The question often asked by non-Muslims is: which Muslim country has ‘Islamized’ its economy in the past 40 years? Eventually, this question has to be answered and supported with actual data! May be, a more precise wording for a test for Islamic finance is the ‘public reach and awareness’ test before it can be considered a ‘public good.’ Scridb filter |

Tags

Categories

Popular Posts

Sorry. No data so far.

Popular Posts

Sorry. No data so far.