Posts tagged as: HSBC back to homepage

|

International Banks Lose Their Fascination For Gulf(0) Major international banks from the United States and the European Union are selling off units, restructuring, recapitalising, and shrinking their operations as they comply with stricter regulatory regimes and face poor economic growth in their main markets. In this context, the Gulf, which at one point was an exotic new outpost brimming with petrodollars, no longer seem like an irresistible proposition. |

|

What’s In Store For The Global Economy In Second Half(0) As investors say goodbye to the first half of the year and brace themselves for a strange and uncertain world in the second half, the worry beads are already out.Global economies have stuttered, faced natural disaster of epic proportions, seen political upheavals that nobody could have forecasted and have seen new and old worries surface and resurface.Yet markets have remained resilient for the most part, commodity-driven economies have prospered and emerging economies are still managing to expand and grow.Here is a look at what is keeping investors awake at night and some bright spots in an increasingly uncertain world. READ MORE HERE |

|

Central Banks Buying To Boost Gold: HSBC(2) Central banks are buying gold, says HSBC. That mean that the metal’s stratospheric rise may not be over yet. And with Goldman Sachs spelling doom for the dollar, gold fundamentals look strong The price of gold is normally determined by a combination of global real interest rates, the value of the U.S. dollar and risk aversion (so-called ‘safe haven’ demand) plus net supply from new production and changes in stocks held by central banks. Calculate them and you get a two-year chart of gold which looks like this: While retail demand from China and India are strong drivers of gold prices, HSBC believes that the arrival of central banks into the fray will mark a new chapter for growth in gold prices. “The change in central bank demand is an important structural difference in net supply and demand conditions relative to the past and it seems set to continue. Central banks in the emerging world remain keen to diversify away from the US dollar and the attraction of precious metals, including gold is unlikely to fade anytime soon.” “Changes in central bank stocks of gold can make a bigger difference to net supply than changes in production because of the huge size of stocks relative to annual production. Central banks are the holders of the largest stock piles of gold. For many years they were net sellers of gold. They preferred to own assets that generated a running yield because the focus was on improving the rate of return on their assets,” says HSBC. Concern about dollar weakness and debasement from ultra loose monetary policy has turned central banks into a source of net demand for gold not net supply. Central banks in India, China, Russia and Mexico have recently been buyers of gold in an effort to diversify their foreign exchange reserves away from excessive dependence on US treasuries and other US dollar-denominated assets. The figures from World Gold Council confirm that trend. “Significant purchases by central banks across a number of regions in the first quarter reinforced gold’s vital role as a reserve asset. Purchases by central banks jumped to 129.0 tonnes (US$5.7-billion), more than the total for 2010 as a whole,” says WGC, which believes 2011 will see more central banks turn to gold purchasing programmes as a means of diversifying their reserves. Central banks of emerging economies remain under weight in their gold hoardings and WGC expects the rebalancing to continue. The growth will be largely driven by the People’s Bank of China (PBOC), the country’s central bank, which is already the sixth largest official holder of gold. Still, gold is a mere 1.6% of its overall reserves and the statements coming out of the PBOC suggest that it views gold as a strong investment alternative to offset rising inflation and global instability. Apart from central banks, investors are also piling in. Despite the high prices, demand for gold in the first quarter rose by 100tonnes, to reach 981.3 tonnes, worth $43.7-billion. “Much of the 100-tonne increase in demand was due to strong growth in the investment sector. We believe that suitable conditions remain in place to ensure that investment demand will maintain its solid growth in the coming quarters.” GOLD VS DOLLAR Here are Goldman Sachs’ two reasons why the dollar will sink again: U.S. trade and investment balances with the rest of the world remain negative. “The U.S. trade deficit is still widening and we expect it to continue to widen,” Goldman analysts said in its note. “Ultimately, it is difficult to envisage a dollar-bullish scenario without a notably stronger U.S tradable goods sector.” The bank says continued deterioration in the trade balance will pass through into a continued deterioration of the U.S. current account deficit. For the dollar to strengthen in this scenario, foreign appetite for U.S. assets need to pick up substantially to have the deficit financed through foreign direct investment and portfolio inflows, Goldman says. But data shows that is not happening. The Fed will be the last among major economies to raise interest rates, and the U.S. Federal Reserve will leave interest rates on hold this year and next. The bank now sees EUR/USD at 1.45, 1.50 and 1.55 in three, six and 12 months vs 1.40, 1.45 and 1.50 previously. It projects $/JPY at 82, 82 and 86 over three, six and 12 months from 86, 86 and 90, previously. With such structural forces driving gold, the fundamentals for the yellow metal look solid. But fundamentals don’t always drive markets. © alifarabia.com |

|

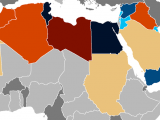

Egypt Will Surpass Saudi Economy By 2050: HSBC(0) Egypt will surpass Saudi Arabia as the region’s largest economy by 2050 and emerge as the 19th largest economy in the world, according to an HSBC report. Read More Here |

|

The world may have 49 years of oil left: HSBC(1) HSBC’s energy outlook for 2050 forecasts that we may have as little as 49 years of oil left and we will have to radically alter our energy consuming ways to avoid a massive energy crunch. Read More |

Tags

Categories

Popular Posts

Sorry. No data so far.

Recent Posts

- 50 Amazing MENA Economic Indicators For 2011

- Quick View: Saudi Nominal GDP to Hit 29% In 2011-KAMCO

- Islamic Finance: A ‘come together’ consolidation?

- EU Bank Deleveraging Could Impact On MENA Economies

- Iraqi Oil Replacing Iranian Oil?

- OPEC Outlook: Oil’s Not Well

- MENA 2012 Outlook: Oil Exporting Countries

- Is Gold Rally Over?

- MENA Projects: Saudi Arabia Still the Driving Force; UAE Slowdown Continues

- SPECIAL COMMENT: The Arab Spring Could Turn Into A Long And Cruel Winter