Posts tagged as: India back to homepage

|

2011: Year of Shariah Compliant Index Out Performance(0) January 17, 2012 By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters “The proper man understands equity, the small man profits.” Confucius. The year 2011 was the year for [Malaysia] Shariah compliant index out-performance against all conventional developed and emerging market country indicies and almost all frontier countries. The Islamic finance industry has not talked up the Islamic equity capital market story, as the Islamic debt capital market poster child, ‘Sukuk,’ has become the alter-ego of Islamic finance. But, does that amount to concentration brand and business risk for a $1 trillion, where Sukuk are, at best, 20% of Islamic finance? |

|

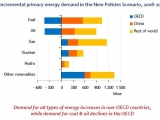

Peak Oil: Are We In The Midst Of The Mother Of All Commodity Paradigm Shifts?(1) Worried about ‘peak oil’? How about ‘peak everything’? A GMO analyst crunches the numbers to show why the structural shifts in the world’s consumption patterns will alter the way we view and invest in commodities. The world is using up its natural resources at an alarming rate, and this has caused a permanent shift in their value and we all need to adjust our behaviour to this new environment. It would help if we did it quickly, says Jeremy Grantham, co-founder of GMO, a global investment firm managing $107-billion in client assets. |

|

Global Recovery May Slip On High Oil, But Boost Saudi Economy: IMF(1) Oil prices will rise 36% in 2011, denting global economic recovery, warns the IMF. But that also means Saudi’s GDP will rise 7.5% - one of the highest among G20 nations. Read More Here |

|

McKinsey’s Future Middle East and Global Cities Report Highlights Cairo, Doha and Al Ain - yes, Al Ain(0) Reading McKinsey’s Urban World: Mapping The Power Of Cities convinces us that the world will belong to China by 2025 - we will just be living in it. Forget the Middle East and its oil wealth, or Latin America with its flair, charm and commodity-fuelled brilliance, or even India with its bursting economic ingenuity and labour power - China will dominate the proceedings. Read More Here |

|

The world may have 49 years of oil left: HSBC(1) HSBC’s energy outlook for 2050 forecasts that we may have as little as 49 years of oil left and we will have to radically alter our energy consuming ways to avoid a massive energy crunch. Read More |

|

Japan’s Nuclear Crisis Is Boon For Middle East Energy(1) As Japan’s nuclear meltdown puts the brakes on yet another power source, the world is looking at ME energy to fill the gap. Luckily, there is plenty coming on line, despite the region’s shot-term problems. Read More

|

Tags

Categories

- Africa

- Bahrain

- Central Asia

- Egypt

- Egypt & MENA

- Featured Gold

- Featured Islamic Finance

- Featured Qatar

- Featured Saudi Arabia

- Featured UAE

- Feaured Egypt

- Gold

- Hot Topics

- Iraq

- Islamic Finance

- Kuwait

- Libya

- Macroeconomic Data

- Markets

- North Africa

- Oil

- Oman

- Qatar

- Saudi Arabia

- Slider

- The Levant

- UAE

- Videos We Like

Popular Posts

Africa’s fastest growing cities

Africa’s fastest growing cities  Middle East’s Top 25 Banks

Middle East’s Top 25 Banks  100 Largest Economies By 2050: HSBC

100 Largest Economies By 2050: HSBC  Rushdi Siddiqui: Is the Islamic finance industry ready for social media?

Rushdi Siddiqui: Is the Islamic finance industry ready for social media?  Hitchhiker’s Guide To Arab Spring (Caution: Humor Required)

Hitchhiker’s Guide To Arab Spring (Caution: Humor Required)  SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital

SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital  Why The Arab Spring May Yet Come To Saudi Arabia

Why The Arab Spring May Yet Come To Saudi Arabia  Forbes Billionaires’ List: Middle East’s Richest Lost Big Last Year

Forbes Billionaires’ List: Middle East’s Richest Lost Big Last Year  What’s in store for Dubai Inc. In 2012?

What’s in store for Dubai Inc. In 2012?  Qatar, Kuwait & UAE’s Ecological Footprint Biggest in World: WWF

Qatar, Kuwait & UAE’s Ecological Footprint Biggest in World: WWF

Popular Posts

Sorry. No data so far.