Posts tagged as: Islamic Development Bank back to homepage

|

Open Letter to IDB President: Mega Islamic Trading Platform(0) By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters Dear Dr. Ahmad Mohamed Ali, President, Islamic Development Bank (IDB) Group: Asalaam Alaikum: The Islamic finance world welcomes your comments on the ‘Mega’ Islamic Bank to effectively compete against well capitalized conventional financial institutions. “…The ‘Mega Islamic Bank’ comes as an initiative of the Islamic Development Bank in its efforts to address the dearth of senior financiers, the absence of the Islamic tools of stock exchange and the absence of market liquidity between Islamic banks.” However, $1 billion, with $500 million in paid capital by the three founders (IDB, Dallah Albaraka and Qatar Government), is smaller than three existing Islamic banks, which have never addressed themselves as ‘mega.’ The three include Saudi Arabia’s Al Rajhi, Qatar’s Mashraf Al Rayan and Kuwait’s Kuwait Finance House (KFH). Furthermore, it seems the ‘mega’ story may be incomplete without Malaysia’s participation. Scridb filter |

|

Rushdi Siddiqui: Interview with Daud Vicary Abdullah, CEO of Inceif(0) By Rushdi Siddiqui Daud Vicary Abdullah is an authority on Islamic banking and has contributed to a number of books on the subject. He has been in the finance and consulting industry for more than 38 years, with significant experience in Asia, Europe, Latin America and the Middle East. Meet Daud Vicary Abdullah, the president and CEO of International Centre of Education in Islamic Finance (Inceif), the global university of Islamic finance. |

|

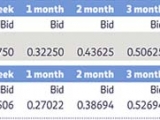

A Step Forward For Islamic Finance Authenticity: IIBR(0) By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters ‘Don’t cheat the world of your contribution. Give it what you’ve got.’ - Steven Pressfield On November 22, 2011, the world’s first Islamic interbank benchmark rate (IIBR) was launched. It is the result of a collaborative approach taken by many Islamic financial institution, industry associations, and Shariah scholars, over the course of 24 months, to a decades-old industry challenge: how to decouple Islamic finance from a conventional Western pricing benchmark (LIBOR) and the law of necessity when an ‘Islamic’ alternative was not available. The objective was to support and preserve Islamic finance authenticity. |

|

SPECIAL COMMENT: A Different Kind of Consolidation in Islamic Finance(0) One of the most over-used words in Islamic finance is not standardization, scholars, regulations, etc., but ‘consolidation’. Islamic banks, Islamic leasing companies, Takaful companies need to consolidate to reach size and achieve scale. As larger capitalized entities, they can better compete with not just the Islamic windows and subsidiaries of conventional banks and insurance companies (like HSBC or Prudential) but eventually the larger conventional financial institutions for mandates on project finance, M&A, buyouts, and so on. Then again, what about consolidation amongst the Islamic industry bodies, the likes of AAOIFI (Accounting and Auditing Organization of Islamic Financial Institutions), IIRA (International Islamic Rating Agency), IIFM (International Islamic Financial Market), and CIBAFI (General Council for Islamic Banks & Financial Institutions)? |

Tags

Categories

Popular Posts

Sorry. No data so far.

Popular Posts

Sorry. No data so far.