Posts tagged as: Kuwait back to homepage

|

The Weakest Link: Short-Term Liquidity & How It Impacts Islamic Finance(0) By Rusdhi Siddiqui, Global Head of Islamic Finance at Thomson Reuters Let me start off with a loaded question, what one word in Islamic finance is as important as Shari’ah, tax, accounting, regulation, and standardisation (STARS)? |

|

Kuwait’s Canadian Move(0)

Report of Kuwaiti interest in Canadian oil sands companies highlights the treasure trove of oil riches in the North American country. CONTINUE READING |

|

USD76Bn Of Gulf Debt Set To Mature By 2014(0) More than USD76-billion of bond and sukuk debt is expected to mature by 2014, according to Kuwait Financial Centre ( Markaz ) research. CONTINUE READING |

|

Kuwait’s Semi-Democracy(0) The failed Kuwait-Dow Chemical mega deal is regarded as one of the biggest examples of how the Kuwaiti parliament has hindered the country’s economic progress. CONTINUE READING |

|

Mushtak Parker Speaks His Mind(0) Leading journalist on Islamic finance tells why he is often ‘harsh’ on the industry and his other views “To be persuasive we must be believable; to be believable we must be credible; (to be) credible we must be truthful.” Edward Murrow. |

|

NBK Chief Ibrahim Dabdoub’s Frustration(0) Ibrahim Dabdoub’s criticism of Kuwait’s economic malaise highlights the banking sector’s frustration over lack of government reforms and lethargic private sector growth. CONTINUE READING |

|

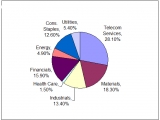

SPECIAL COMMENT: OIC Islamic Index - The Malaysia Story?(0) By Rushdi Siddiqui, Global Head Of Islamic Finance, Thomson Reuters There were two important announcements last week concerning Islamic equity index: 1. Malaysia’s Securities Commission ‘…announced the adoption of a revised screening methodology to determine the Shariah-compliant status of listed companies …’ |

|

Exclusive: Lessons for Islamic Finance Expansion - Emirates Airline(0) By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters Islamic finance has reached it natural market share in certain markets according a recent A.T. Kearney report, hence, an early ‘amber colored flag alert’ on the need for international expansion. Islamic finance needs to find an example of a model company, ideally from the Muslim world, which has become a global player based upon customer service, unique selling proposition, innovation, demand, and a charismatic leader. Should it also look to the west, and examine the likes of Google, Apple, Coca Cola or Pepsi, ExxonMobil, etc.? Does it look at the management style of former GE Chairman Jack Welsh or the vision of the late Steve Jobs? |

|

Islamic finance must finance its diversification(0) By Rushdi Siddiqui, Global Head Of Islamic Finance, Thomson Reuters Islamic finance is usually described as an infant market with domestic focus and supported by the government, hence, much like a baby reliant upon it parents in a home environment of nutrition, nurturing, and natural growth. “To be competitive in the new world order, one has to think like an immigrant, create like an artisan, work like a start-up and provide service like a waitress, and continuously create a unique value add.” Thomas Friedman, Foreign Affairs Correspondent of the NY Times. |

|

Qatar, Kuwait & UAE’s Ecological Footprint Biggest in World: WWF(0)

Here’s a list Qatar would not want to top: The World Wild Life Fund (WWF) has ranked Qatar as the country with the largest ecological footprint per capita in its latest report. The tiny country is joined by neighbours Kuwait and the United Arab Emirates as the three nations with the largest ecological footprint - far exceeding other countries. READ MORE HERE |

Tags

Categories

- Africa

- Alifarabia.com

- Angola

- Bahrain

- Central Asia

- Egypt

- Egypt & MENA

- Featured Gold

- Featured Islamic Finance

- Featured Qatar

- Featured Saudi Arabia

- Featured UAE

- Feaured Egypt

- Ghana

- Gold

- Gulf

- Hot Topics

- Iraq

- Islamic Finance

- Kenya

- Kuwait

- Libya

- Macroeconomic Data

- Markets

- Nigeria

- North Africa

- Oil

- Oman

- Qatar

- Rwanda

- Saudi Arabia

- Slider

- South Africa

- Tanzania

- The Levant

- UAE

- Uncategorized

- Videos We Like

Popular Posts

The weakest link: short-term liquidity and how it impacts Islamic finance

The weakest link: short-term liquidity and how it impacts Islamic finance  Islamic finance: An industry inclusive to all, irrespective of background

Islamic finance: An industry inclusive to all, irrespective of background  SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital

SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital  Media and public relations — the missing link in Islamic finance

Media and public relations — the missing link in Islamic finance  SPECIAL COMMENT: OIC Islamic Index - The Malaysia Story?

SPECIAL COMMENT: OIC Islamic Index - The Malaysia Story?  SPECIAL COMMENT: Ramadan Wish List For Islamic Finance

SPECIAL COMMENT: Ramadan Wish List For Islamic Finance  Natural gas to be fastest growing energy source

Natural gas to be fastest growing energy source  Dull economy takes shine away from Cameroon

Dull economy takes shine away from Cameroon  Mozambique political tensions seen rising in 2014

Mozambique political tensions seen rising in 2014  Muslim consumerism is linked to real economy sectors

Muslim consumerism is linked to real economy sectors

Popular Posts

Sorry. No data so far.