Posts tagged as: Middle East back to homepage

|

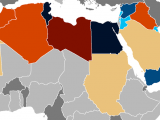

50 Amazing MENA Economic Indicators For 2011(0)

The year 2011 has been extraordinary not just for the tectonic shift in the region’s political structures, but also the extraordinary pressures and opportunities faced by many regional economies. With four dictators ousted - including one dead - many others were shaken to the core - the after shocks have reverberated throughout the region in 2011 and will no doubt be felt in 2012. We identify 50 amazing statistics that highlight the remarkable year: READ MORE HERE |

|

Islamic Finance: A ‘come together’ consolidation?(0) Will 2012 be the year of “come together” consolidation for Islamic banks? Size is often the justification for achieving economies of scale, used to access deals for league table prominence, used as a buffer in a challenging environment, used as defensive measure to ward off unwanted suitors, and so on. Islamic banks are very much like Islamic (equity) funds. There are hundreds of Islamic banks and funds, but the paid-up capital and assets under management, respectively, is too small to be meaningful. Yet, both, more so Islamic banks, present a unique situation (of an industry risk) of “too small to fail”. |

|

EU Bank Deleveraging Could Impact On MENA Economies(0) Deleveraging in EU banks is one of the many issues impacting the ME economies in the 2012. Tourism, trade, investment and oil exports could also suffer as the EU crisis unravels. All eyes are fixed on the European Union these days, as the region remains mired in a sovereign debt crisis that threatens the very future of the economic bloc. READ MORE HERE |

|

The Kurdish Conflict: The Real Challenge To Turkey’s Democracy(0)

By Alon Ben-Meir In the wake of the Arab Spring and Prime Minister Erdogan’s championing of political reforms throughout the Arab world, it has now become more urgent than ever before to find an equitable solution to the Turkish-Kurdish conflict. Short of finding an immediate resolution to this debilitating struggle will not only severely compromise Turkey’s suggested model of successfully combining Islam and democracy, but it will additionally bankrupt its moral standing as it willfully continues to discriminate against 15 million Kurds who represent one-fifth of its population. |

|

Arab Spring: A New Era In A Transforming Globe(0)

November 8, 2011 The Arab uprising must be seen as an integral part of a world in transformation. The technological and informational revolutions that have spurred (and continue to spur) globalization and interconnectedness between cultures make it impossible for tyrants to rule for the entirety of their lifetimes while mercilessly subjugating their peoples to lives of servitude with no prospect of ever tasting the true meaning of freedom. |

|

5 Questions About Global Economy Answered & Where’s The Next Bubble: Barclays(0)The next bubble may be forming in developed sovereign debtThe October 2011 edition of Barclays Wealth Compass, entitled “Perspectives on Markets: Yesterday, Today and Tomorrow,” reflects upon the past two decades of market volatility with an eye toward understanding and positioning for the future. The firm’s chief investment officer and heads of regional Investment Strategy, Behavioural Finance and Quantitative Analytics answer five key questions in the special edition. |

|

China’s Hard Landing Will Hurt Middle East Economic Prospects(0) The EU and the US economies are not the only headaches for Middle East economies. China’s faltering economy could also hurt the region’s growth prospects. As the advanced economies were contracting and falling behind earlier in the year, the Gulf and the wider MENA states were hoping Chinese and wider Asian demand to ensure their oil production finding eager buyers. READ MORE HERE |

|

$1.6T Middle East Projects Are Delayed Or Cancelled: Citibank(0) Close to $1.6-trillion worth of projects are cancelled or are on hold in the Middle East and East North African market, with $800-billion in the UAE alone, according to Citibank. The statistics are a reflection of the hangover of the leveraged days in the region when billion dollar projects were announced virtually every other day. Read More Here |

|

Middle East States’ Foreign Assets To Hit $2.2 Trillion By Year End: IIF(0) The Arab World’s foreign assets will rise to a stunning $2.2-trillion this year, says the IIF. But the key to growth in the region will not be financial resources but structural reforms, otherwise tensions will remain. Read More Here |

|

Saudi GDP To Nearly Double By 2014: Citibank(0) There is no doubt that Saudi Arabia has extended itself with its latest domestic spending programme. So much so that sustained dips in oil price could turn its budget surplus for the year into a deficit. Read More Here |

Tags

Categories

- Africa

- Alifarabia.com

- Angola

- Bahrain

- Central Asia

- Egypt

- Egypt & MENA

- Featured Gold

- Featured Islamic Finance

- Featured Qatar

- Featured Saudi Arabia

- Featured UAE

- Feaured Egypt

- Ghana

- Gold

- Gulf

- Hot Topics

- Iraq

- Islamic Finance

- Kenya

- Kuwait

- Libya

- Macroeconomic Data

- Markets

- Nigeria

- North Africa

- Oil

- Oman

- Qatar

- Rwanda

- Saudi Arabia

- Slider

- South Africa

- Tanzania

- The Levant

- UAE

- Uncategorized

- Videos We Like

Popular Posts

The weakest link: short-term liquidity and how it impacts Islamic finance

The weakest link: short-term liquidity and how it impacts Islamic finance  Islamic finance: An industry inclusive to all, irrespective of background

Islamic finance: An industry inclusive to all, irrespective of background  SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital

SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital  Media and public relations — the missing link in Islamic finance

Media and public relations — the missing link in Islamic finance  SPECIAL COMMENT: OIC Islamic Index - The Malaysia Story?

SPECIAL COMMENT: OIC Islamic Index - The Malaysia Story?  SPECIAL COMMENT: Ramadan Wish List For Islamic Finance

SPECIAL COMMENT: Ramadan Wish List For Islamic Finance  Natural gas to be fastest growing energy source

Natural gas to be fastest growing energy source  Dull economy takes shine away from Cameroon

Dull economy takes shine away from Cameroon  Mozambique political tensions seen rising in 2014

Mozambique political tensions seen rising in 2014  Muslim consumerism is linked to real economy sectors

Muslim consumerism is linked to real economy sectors

Popular Posts

Sorry. No data so far.