Posts tagged as: risk back to homepage

|

Islamic Finance: A ‘come together’ consolidation?(0) Will 2012 be the year of “come together” consolidation for Islamic banks? Size is often the justification for achieving economies of scale, used to access deals for league table prominence, used as a buffer in a challenging environment, used as defensive measure to ward off unwanted suitors, and so on. Islamic banks are very much like Islamic (equity) funds. There are hundreds of Islamic banks and funds, but the paid-up capital and assets under management, respectively, is too small to be meaningful. Yet, both, more so Islamic banks, present a unique situation (of an industry risk) of “too small to fail”. Scridb filter |

|

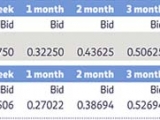

A Step Forward For Islamic Finance Authenticity: IIBR(0) By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters ‘Don’t cheat the world of your contribution. Give it what you’ve got.’ - Steven Pressfield On November 22, 2011, the world’s first Islamic interbank benchmark rate (IIBR) was launched. It is the result of a collaborative approach taken by many Islamic financial institution, industry associations, and Shariah scholars, over the course of 24 months, to a decades-old industry challenge: how to decouple Islamic finance from a conventional Western pricing benchmark (LIBOR) and the law of necessity when an ‘Islamic’ alternative was not available. The objective was to support and preserve Islamic finance authenticity. |

|

Dubai Among 10 Sovereigns Most Likely To Default(0) Gulf states saw their default risks subside considerably during the second quarter as investors shrugged off the Arab Spring and focused on the troubled EU states. Still, Dubai remained among the list of sovereigns most likely to default. Dubai, which was ranked as the 7th most risky sovereign in the first quarter, is now at the edge of the list of 10 countries most likely to default, according to data from the second quarter of 2011. READ MORE HERE Scridb filter |

|

Middle East Sovereign Debtors Seen As Among Riskiest By Global Investors(1) Saudi Arabia is no longer in the list of the ten safest sovereign debtors in the world, meanwhile Lebanon, Iraq, Dubai and Egypt all find themselves in the list of ten riskiest sovereign debtors, according to new data. Read More |

|

Black Swan Fatigue?(1) The world is going through one disaster after another. But are these all Black Swan events or known unknowns? But are these events occuring more frequently, or are they just being better reported? What’s a risk manager to do? Read More |

Tags

Categories

Popular Posts

Sorry. No data so far.

Popular Posts

Sorry. No data so far.