Posts tagged as: Shariah back to homepage

|

2011: Year of Shariah Compliant Index Out Performance(0) January 17, 2012 By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters “The proper man understands equity, the small man profits.” Confucius. The year 2011 was the year for [Malaysia] Shariah compliant index out-performance against all conventional developed and emerging market country indicies and almost all frontier countries. The Islamic finance industry has not talked up the Islamic equity capital market story, as the Islamic debt capital market poster child, ‘Sukuk,’ has become the alter-ego of Islamic finance. But, does that amount to concentration brand and business risk for a $1 trillion, where Sukuk are, at best, 20% of Islamic finance? |

|

SPECIAL COMMENT: Shariah Equity Compliance in the West(1) By Rushdi Siddiqui, Global Head of Islamic Finance at Thomson Reuters The time has arrived to take a deeper dive on better understanding of Shariah compliant companies in an Islamic (or Shariah compliant) equity indexes. To many informed and uninformed observers of Islamic equity investing, it seems to imply investing in publicly listed companies in Muslim countries. The end results contradict the assumptions. This also rebuts the often heard allegations by many from the anti-Shariah movement that Islamic investing is about investing in companies linked to terrorism or financing terrorism. The largest companies in the S&P Global BMI Shariah include ExxonMobil, IBM, Chevron, Nestle, Microsoft, etc. |

|

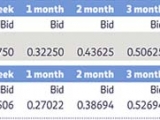

A Step Forward For Islamic Finance Authenticity: IIBR(1) By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters ‘Don’t cheat the world of your contribution. Give it what you’ve got.’ - Steven Pressfield On November 22, 2011, the world’s first Islamic interbank benchmark rate (IIBR) was launched. It is the result of a collaborative approach taken by many Islamic financial institution, industry associations, and Shariah scholars, over the course of 24 months, to a decades-old industry challenge: how to decouple Islamic finance from a conventional Western pricing benchmark (LIBOR) and the law of necessity when an ‘Islamic’ alternative was not available. The objective was to support and preserve Islamic finance authenticity. |

|

Survey: Revival & Reach of Islamic Finance(1) By Rushdi Siddiqui, Global Head, Islamic Finance & OIC Countries Thomson Reuters It’s polling time once again in Islamic finance, but, today, we survey two major developments: Arab revolution and death of Osama Bin Laden (OBL), and examine the consequences, if any, on Islamic finance on the Maghreb and anti-Shariah countries. Interestingly, the million-dollar mansion living OBL and his executive team camped in ‘cave gate-aways’ witnessed in real time the Al Qaeda ideology of hate, mayhem and murder discredited by a highly educated, but very poor Tunisian fruit-seller seeking dignity of work in providing for his family. |

Tags

Categories

- Africa

- Bahrain

- Central Asia

- Egypt

- Egypt & MENA

- Featured Gold

- Featured Islamic Finance

- Featured Qatar

- Featured Saudi Arabia

- Featured UAE

- Feaured Egypt

- Gold

- Hot Topics

- Iraq

- Islamic Finance

- Kuwait

- Libya

- Macroeconomic Data

- Markets

- North Africa

- Oil

- Oman

- Qatar

- Saudi Arabia

- Slider

- The Levant

- UAE

- Videos We Like

Popular Posts

Africa’s fastest growing cities

Africa’s fastest growing cities  Middle East’s Top 25 Banks

Middle East’s Top 25 Banks  100 Largest Economies By 2050: HSBC

100 Largest Economies By 2050: HSBC  Hitchhiker’s Guide To Arab Spring (Caution: Humor Required)

Hitchhiker’s Guide To Arab Spring (Caution: Humor Required)  SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital

SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital  Rushdi Siddiqui: Is the Islamic finance industry ready for social media?

Rushdi Siddiqui: Is the Islamic finance industry ready for social media?  Forbes Billionaires’ List: Middle East’s Richest Lost Big Last Year

Forbes Billionaires’ List: Middle East’s Richest Lost Big Last Year  Why The Arab Spring May Yet Come To Saudi Arabia

Why The Arab Spring May Yet Come To Saudi Arabia  What’s in store for Dubai Inc. In 2012?

What’s in store for Dubai Inc. In 2012?  Qatar, Kuwait & UAE’s Ecological Footprint Biggest in World: WWF

Qatar, Kuwait & UAE’s Ecological Footprint Biggest in World: WWF

Popular Posts

Sorry. No data so far.