Posts tagged as: Turkey back to homepage

|

SPECIAL COMMENT: The Arab Spring Could Turn Into A Long And Cruel Winter(0) By Alon Ben-Meir Due to a host of common denominators in the Arab world including the lack of traditional liberalism, the tribes’ power, the elites’ control of business, the hold on power by ethnic minorities, the military that cling to power, and the religious divide and Islamic extremism, the Arab Spring could sadly turn into a long and cruel winter. These factors are making the transformation into a more reformist governance, slow, filled with hurdles and punctuated with intense bloodshed. At the same time, each Arab country differs characteristically from one another on other dimensions including: history and culture, demographic composition, the role of the military, resources, and geostrategic situations. This combination of commonality and uniqueness has had, and will continue to have, significant impacts on how the uprising in each Arab country evolves and what kind of political order might eventually emerge. |

|

SPECIAL COMMENT: Shariah Equity Compliance in the West(1) By Rushdi Siddiqui, Global Head of Islamic Finance at Thomson Reuters The time has arrived to take a deeper dive on better understanding of Shariah compliant companies in an Islamic (or Shariah compliant) equity indexes. To many informed and uninformed observers of Islamic equity investing, it seems to imply investing in publicly listed companies in Muslim countries. The end results contradict the assumptions. This also rebuts the often heard allegations by many from the anti-Shariah movement that Islamic investing is about investing in companies linked to terrorism or financing terrorism. The largest companies in the S&P Global BMI Shariah include ExxonMobil, IBM, Chevron, Nestle, Microsoft, etc. |

|

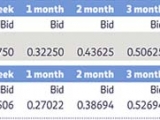

A Step Forward For Islamic Finance Authenticity: IIBR(1) By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters ‘Don’t cheat the world of your contribution. Give it what you’ve got.’ - Steven Pressfield On November 22, 2011, the world’s first Islamic interbank benchmark rate (IIBR) was launched. It is the result of a collaborative approach taken by many Islamic financial institution, industry associations, and Shariah scholars, over the course of 24 months, to a decades-old industry challenge: how to decouple Islamic finance from a conventional Western pricing benchmark (LIBOR) and the law of necessity when an ‘Islamic’ alternative was not available. The objective was to support and preserve Islamic finance authenticity. |

|

The Kurdish Conflict: The Real Challenge To Turkey’s Democracy(0)

By Alon Ben-Meir In the wake of the Arab Spring and Prime Minister Erdogan’s championing of political reforms throughout the Arab world, it has now become more urgent than ever before to find an equitable solution to the Turkish-Kurdish conflict. Short of finding an immediate resolution to this debilitating struggle will not only severely compromise Turkey’s suggested model of successfully combining Islam and democracy, but it will additionally bankrupt its moral standing as it willfully continues to discriminate against 15 million Kurds who represent one-fifth of its population. |

|

SPECIAL COMMENT: Turkish exchange plans ties with UAE and Egyptian markets(0)

By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters Turkey has been building capital market bridges to GCC and South East Asia, and chairman of the Istanbul Stock Exchange, Hussain Erkan, has been a leading architect in establishing dialogue, hosting events, and facilitating cooperation and coordination with his counterparts for both Islamic and conventional finance. In this interview, Erkan shares his thoughts on the challenges and progress of Islamic finance in Turkey, among various other issues. He is hopeful that the improvements made should be able to attract investors from the GCC. |

|

SPECIAL COMMENT: Does Islamic Finance have A.I.R. (Authenticity, Innovation & Reach)?(0) At the Joint High Level Conference on Islamic Finance in Jakarta, Indonesia, co- organized by Bank Negara Malaysia and Bank Indonesia, the question I wanted to address was: Does Islamic Finance have A.I.R. (Authenticity, Innovation & Reach) or is it just hot air? |

|

Recycling Petrodollars To Curb Inflation In Emerging Markets(1) While oil inflation fears in emerging markets are warranted, these risks are being mitigated as Gulf oil-exporting states buy emerging market products and services as part of their fiscal spending spree. |

Tags

Categories

- Africa

- Bahrain

- Central Asia

- Egypt

- Egypt & MENA

- Featured Gold

- Featured Islamic Finance

- Featured Qatar

- Featured Saudi Arabia

- Featured UAE

- Feaured Egypt

- Gold

- Hot Topics

- Iraq

- Islamic Finance

- Kuwait

- Libya

- Macroeconomic Data

- Markets

- North Africa

- Oil

- Oman

- Qatar

- Saudi Arabia

- Slider

- The Levant

- UAE

- Videos We Like

Popular Posts

Africa’s fastest growing cities

Africa’s fastest growing cities  Middle East’s Top 25 Banks

Middle East’s Top 25 Banks  100 Largest Economies By 2050: HSBC

100 Largest Economies By 2050: HSBC  Hitchhiker’s Guide To Arab Spring (Caution: Humor Required)

Hitchhiker’s Guide To Arab Spring (Caution: Humor Required)  Rushdi Siddiqui: Is the Islamic finance industry ready for social media?

Rushdi Siddiqui: Is the Islamic finance industry ready for social media?  SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital

SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital  Forbes Billionaires’ List: Middle East’s Richest Lost Big Last Year

Forbes Billionaires’ List: Middle East’s Richest Lost Big Last Year  Why The Arab Spring May Yet Come To Saudi Arabia

Why The Arab Spring May Yet Come To Saudi Arabia  What’s in store for Dubai Inc. In 2012?

What’s in store for Dubai Inc. In 2012?  Qatar, Kuwait & UAE’s Ecological Footprint Biggest in World: WWF

Qatar, Kuwait & UAE’s Ecological Footprint Biggest in World: WWF

Popular Posts

Sorry. No data so far.