Posts tagged as: U.S. back to homepage

|

5 Questions About Global Economy Answered & Where’s The Next Bubble: Barclays(0)The next bubble may be forming in developed sovereign debtThe October 2011 edition of Barclays Wealth Compass, entitled “Perspectives on Markets: Yesterday, Today and Tomorrow,” reflects upon the past two decades of market volatility with an eye toward understanding and positioning for the future. The firm’s chief investment officer and heads of regional Investment Strategy, Behavioural Finance and Quantitative Analytics answer five key questions in the special edition. |

|

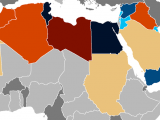

China’s Hard Landing Will Hurt Middle East Economic Prospects(0) The EU and the US economies are not the only headaches for Middle East economies. China’s faltering economy could also hurt the region’s growth prospects. As the advanced economies were contracting and falling behind earlier in the year, the Gulf and the wider MENA states were hoping Chinese and wider Asian demand to ensure their oil production finding eager buyers. READ MORE HERE |

|

No U.S. Rate Hike This Year(0) U.S. Federal Chairman Ben Bernanke says interest rates will remain low and dampened enthusiasm for QE3. But one heavyweight thinks QE3 could come in August. |

|

EIA Vs OPEC: A Goallless Draw?(0) Even if Saudi Arabia was aware of the IEA’s move to draw from its oil reserves, all parties appear to have lost face, without really upsetting the trend of stubbornly high oil prices. Goldman says buy the oil dip. |

|

The world may have 49 years of oil left: HSBC(1) HSBC’s energy outlook for 2050 forecasts that we may have as little as 49 years of oil left and we will have to radically alter our energy consuming ways to avoid a massive energy crunch. Read More |

Tags

Categories

Popular Posts

Sorry. No data so far.

Recent Posts

- 50 Amazing MENA Economic Indicators For 2011

- Quick View: Saudi Nominal GDP to Hit 29% In 2011-KAMCO

- Islamic Finance: A ‘come together’ consolidation?

- EU Bank Deleveraging Could Impact On MENA Economies

- Iraqi Oil Replacing Iranian Oil?

- OPEC Outlook: Oil’s Not Well

- MENA 2012 Outlook: Oil Exporting Countries

- Is Gold Rally Over?

- MENA Projects: Saudi Arabia Still the Driving Force; UAE Slowdown Continues

- SPECIAL COMMENT: The Arab Spring Could Turn Into A Long And Cruel Winter