Posts tagged as: World Bank back to homepage

|

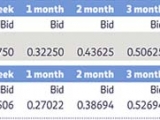

A Step Forward For Islamic Finance Authenticity: IIBR(1) By Rushdi Siddiqui, Global Head of Islamic Finance, Thomson Reuters ‘Don’t cheat the world of your contribution. Give it what you’ve got.’ - Steven Pressfield On November 22, 2011, the world’s first Islamic interbank benchmark rate (IIBR) was launched. It is the result of a collaborative approach taken by many Islamic financial institution, industry associations, and Shariah scholars, over the course of 24 months, to a decades-old industry challenge: how to decouple Islamic finance from a conventional Western pricing benchmark (LIBOR) and the law of necessity when an ‘Islamic’ alternative was not available. The objective was to support and preserve Islamic finance authenticity. |

|

Egypt Spurns The IMF And Rushes Into The Arms Of Gulf States(0) Even as the Egyptian Government looks to revive the country’s economy, it has turned down the International Monetary Fund (IMF)’s stand-by agreement. A bold move no doubt, but was it a populist decision or purely a financial one? And if the Egyptian Government’s decision to turn down the IMF a move to spurn Mubarak-praising entities, why is it borrowing from the Gulf? Egypt’s decision to turn down International Monetary Fund (IMF) and the World Bank is a bold move, given that the country’s fiscal situation remains fragile. READ MORE HERE |

Tags

Categories

- Africa

- Bahrain

- Central Asia

- Egypt

- Egypt & MENA

- Featured Gold

- Featured Islamic Finance

- Featured Qatar

- Featured Saudi Arabia

- Featured UAE

- Feaured Egypt

- Gold

- Hot Topics

- Iraq

- Islamic Finance

- Kuwait

- Libya

- Macroeconomic Data

- Markets

- North Africa

- Oil

- Oman

- Qatar

- Saudi Arabia

- Slider

- The Levant

- UAE

- Videos We Like

Popular Posts

Africa’s fastest growing cities

Africa’s fastest growing cities  Middle East’s Top 25 Banks

Middle East’s Top 25 Banks  100 Largest Economies By 2050: HSBC

100 Largest Economies By 2050: HSBC  Hitchhiker’s Guide To Arab Spring (Caution: Humor Required)

Hitchhiker’s Guide To Arab Spring (Caution: Humor Required)  Rushdi Siddiqui: Is the Islamic finance industry ready for social media?

Rushdi Siddiqui: Is the Islamic finance industry ready for social media?  SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital

SPECIAL COMMENT: Missing Link in Islamic Finance Hubs: Islamic Venture Capital  Forbes Billionaires’ List: Middle East’s Richest Lost Big Last Year

Forbes Billionaires’ List: Middle East’s Richest Lost Big Last Year  Why The Arab Spring May Yet Come To Saudi Arabia

Why The Arab Spring May Yet Come To Saudi Arabia  What’s in store for Dubai Inc. In 2012?

What’s in store for Dubai Inc. In 2012?  Qatar, Kuwait & UAE’s Ecological Footprint Biggest in World: WWF

Qatar, Kuwait & UAE’s Ecological Footprint Biggest in World: WWF

Popular Posts

Sorry. No data so far.